Lenders and suppliers often look at outstanding debt as an indicator of the business’s ability to manage its finances and repay loans. This includes information on how much debt the business currently has, the types of debt (such as credit card debt, loans, etc.), and the amount of available credit. Outstanding debtĪnother essential factor affecting a business’s credit score is the business’s outstanding debt. Lenders and suppliers often look at the payment history as an indicator of the business’s overall financial health. This includes information on whether the business pays its bills on time and whether there are any late payments or outstanding debts. One of the most critical factors affecting a business’s credit score is the business’s payment history. Several factors can affect a business’s credit score. Industry information and risk assessment.What does a business credit check show?Ī business credit check typically shows the following information: Business owners should strive to maintain a good credit standing for their personal and business credit scores. While both scores are essential, business owners must understand that the two are distinct.

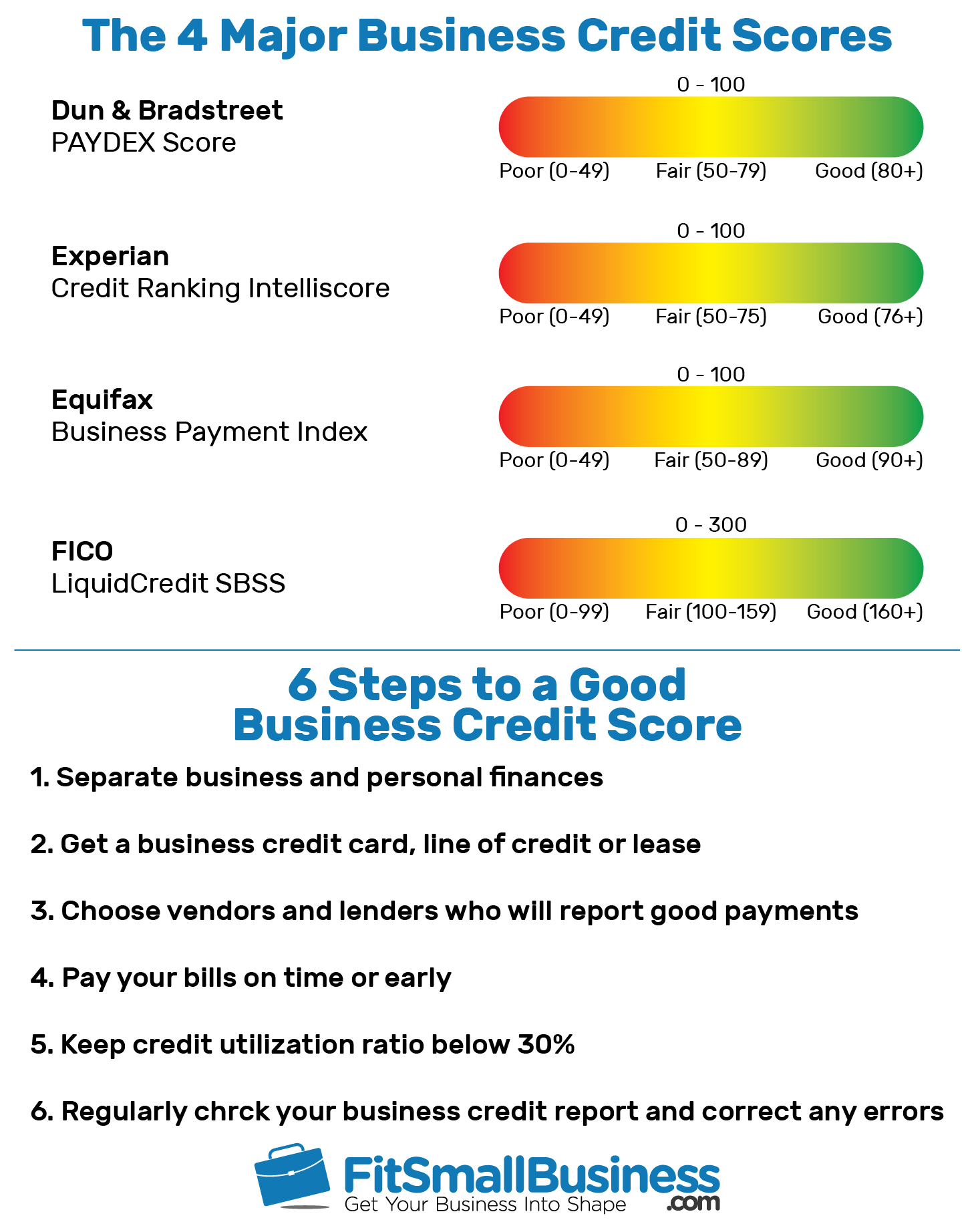

They’ll consider your individual payment history, outstanding debt, and credit utilization. On the other hand, personal credit scores are used by lenders and other financial institutions to assess an individual’s creditworthiness when applying for loans, credit cards, and different types of credit. They’ll consider the business’s payment history, outstanding debt, and credit utilization. A business credit score is based on a business’s credit history, while a personal credit score is based on an individual’s history.īusiness credit scores are used by lenders, landlords, and suppliers to assess the creditworthiness of a business. Yes, a business credit score is different from a personal credit score. Is a Business Credit Score Different From a Personal Credit Score? Maintaining a good credit standing is crucial by paying bills on time, keeping credit utilization low, and monitoring your credit report regularly. It’s important to note that business credit scores can change over time. Credit bureaus use different scoring models and ranges, so a business’s score may vary depending on the source. The score is usually presented as a number on a scale, such as 0 to 100 or 300 to 850, and a higher score indicates better creditworthiness.

These factors can include the length of time the business has been in operation, the number and types of credit accounts, and the business’s payment history. These reports include the business’s credit history, payment history, outstanding debt, and credit utilization.Ĭredit bureaus use a proprietary algorithm that considers various factors to calculate a business credit score. They are used by lenders, landlords, and suppliers to assess creditworthiness and the level of risk by implication.Ī business credit score is typically calculated based on information from a report compiled by specialist credit bureaus such as Experian, Dun & Bradstreet, and Equifax.

0 kommentar(er)

0 kommentar(er)